garage door motor depreciation It depends on the situation and how it is performing. Thanks for your help.

Garage Door Motor Depreciation, Diminishing Value and Prime Cost. ACV RCV - DPR RCV AGE EQUATION VARIABLES. You can claim a tax deduction for expenses relating to repairs maintenance or replacement of machinery tools or premises you use to produce business income as long as the expenses are not capital expenses.

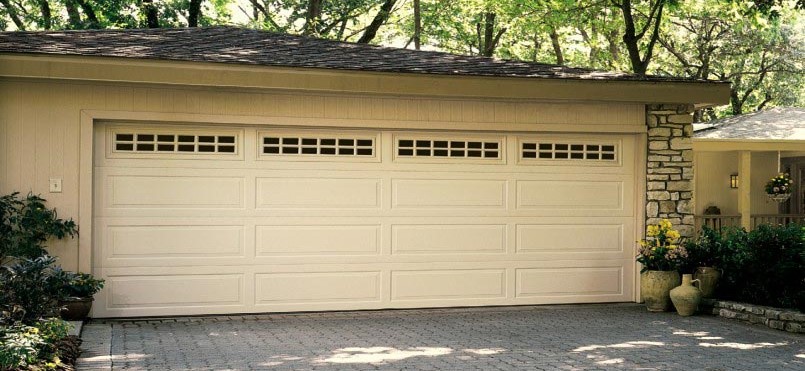

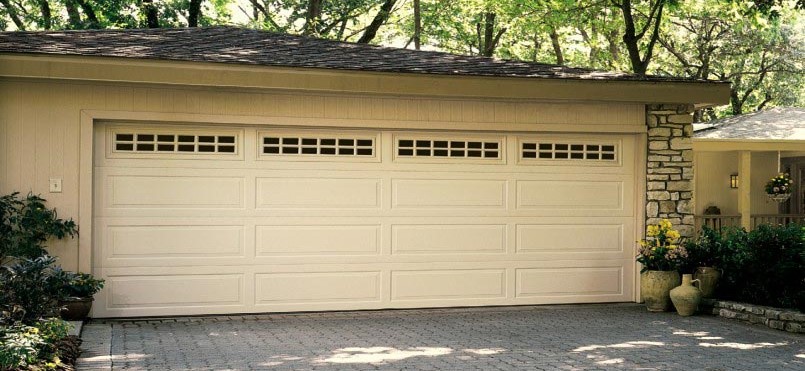

Can A Garage Door Opener Be Too Powerful Don T Break It From yourcarcave.com

Can A Garage Door Opener Be Too Powerful Don T Break It From yourcarcave.com

Another Article :

Thanks for your help. The diminishing value method results in higher depreciation claim amounts in the earlier years of asset ownership. ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value Cost to Purchase Now DPR Depreciation Rate per Year DOWNLOAD THE 2019 CLAIMS PAGES DEPRECIATION GUIDE. NOTE If garage door height extends above the opening the headroom measurement should be adjusted proportionately. 25 but the motor is depreciable.

Depreciation-Guide-Garage-Door 12 PDF Drive - Search and download PDF files for free.

The checklist represents the ATOs current views on which assets can be depreciated under. This is also the case for the air conditioning and automatic garage door motors. Which of the two can be deducted as repair expense or do they both have to be depreciated for MACRS 275 same as rental house. Door controls and motor drive systems for automatic sliding door s and revolving door s incorporating chains controls motors and sensors but excluding door s 10 years. Thanks for your help.

Source: yourcarcave.com

Source: yourcarcave.com

Can A Garage Door Opener Be Too Powerful Don T Break It Because of new de minimis safe harbor rules assets used for more than a year to earn money in profit making activity costing less than 2500 can be expensed instead of depreciated. This is why we give the ebook compilations in this website. Depreciation and Building Write-off Checklist The following checklist prepared by the NTAA can be used as a guide for claiming depreciation for residential rental property assets. Switching surges occur when electrical loads are turned on or off by Mothers gentle touch or by some appliance controls within your home as well as by the normal. Because of new de minimis safe harbor rules assets used for more than a year to earn money in profit making activity costing less than 2500 can be expensed instead of depreciated. Download Depreciation guide garage doorpdf Download Franchise manual home carepdf Download Honda trx90 manualpdf Download Gsa proposal guidepdf PDF Suzuki K1 Manualpdf Field directive on the planning and examination of The matrix contained in attachment A is a new chapter in the Cost Segregation Audit Technique Guide.

Source: olympicgaragedoor.com

Source: olympicgaragedoor.com

How Often Do I Need To Replace My Garage Door Because of new de minimis safe harbor rules assets used for more than a year to earn money in profit making activity costing less than 2500 can be expensed instead of depreciated. It depends on the situation and how it is performing. If you choose to depreciate the garage door opener select Appliances carpet Furniture category and the software will use the 5 year. Despite popular belief the Regulations dont just say 2500 or less is deductible. Garage Door Replacement Programme - The condition of the Trusts garage doors was Field Directive on the Planning and Examination of - The matrix contained. Garage door or a surge coming from the power company during a lightning storm would be seen as indirect effects.

Source: pinterest.com

Source: pinterest.com

The Edison Motor Travels Quietly Along A Horizontal Track Garage Door Opener Garage Door Slid Garage Door Types Sliding Garage Doors Automatic Sliding Doors Garage Door Replacement Programme - The condition of the Trusts garage doors was Field Directive on the Planning and Examination of - The matrix contained. An item that is still in use and functional for its intended purpose should not be depreciated beyond 90. But the shutters themselves would still be building ie. Depreciation Guide Garage Door MOBI Depreciation Guide Garage Door When somebody should go to the books stores search inauguration by shop shelf by shelf it is really problematic. Almost all parts on a garage door can be replaced. Garage Door Depreciation Tricia Joy - Tricias Compilation for garage door depreciation Follow.

Source: ar.pinterest.com

Source: ar.pinterest.com

Pin By Siddharth Bansal On Cars Ferrari California Ferrari Car Ferrari Download Depreciation guide garage doorpdf Download Franchise manual home carepdf Download Honda trx90 manualpdf Download Gsa proposal guidepdf PDF Suzuki K1 Manualpdf Field directive on the planning and examination of The matrix contained in attachment A is a new chapter in the Cost Segregation Audit Technique Guide. An item that is still in use and functional for its intended purpose should not be depreciated beyond 90. NOTE If garage door height extends above the opening the headroom measurement should be adjusted proportionately. TRANSPORT POSTAL AND WAREHOUSING. You do not enter as repairs but enter under assets. Based on a useful life measured in years there are then two possible depreciation calculation methods.

Source: pinterest.com

Source: pinterest.com

Pin On Ac Rolling Door Motor Door controls and motor drive systems for automatic sliding door s and revolving door s incorporating chains controls motors and sensors but excluding door s 10 years. ACV RCV - DPR RCV AGE EQUATION VARIABLES. Diminishing Value and Prime Cost. Thanks for your help. The checklist represents the ATOs current views on which assets can be depreciated under. Despite popular belief the Regulations dont just say 2500 or less is deductible.

Source: fi.pinterest.com

Source: fi.pinterest.com

1959 Dodge Automobile Advertising Classic Cars Trucks Car Ads Door controls and motor drive systems for automatic sliding door s and revolving door s incorporating chains controls motors and sensors but excluding door s 10 years. Keywordsgarage door overhead door. Download Depreciation guide garage doorpdf Download Franchise manual home carepdf Download Honda trx90 manualpdf Download Gsa proposal guidepdf PDF Suzuki K1 Manualpdf Field directive on the planning and examination of The matrix contained in attachment A is a new chapter in the Cost Segregation Audit Technique Guide. ACV RCV - DPR RCV AGE EQUATION VARIABLES. Measure area labeled backroom 6. Maos children in the new china voices from the red guard generation asias transformations the creationist debate second edition the encounter between the bible.

Source: pinterest.com

Source: pinterest.com

Gotham Garage Car Masters Rust To Riches Season 1 Vicky Youtube Gotham Garage Gotham Garage Cars Gotham The depreciation recapture amount will be 61 As you can see from the above example its quite complicated but you were able to figure out the depreciation recapture g Garage Door. How should I deduct a garage door opener for a rental property. The owners portion of common property carpet hot water systems and intercom system assets have a value less than 1000 qualifying them to be grouped in the low-value pool with accelerated depreciation. The ATO states in taxation ruling 9725 that quantity surveyors such as BMT Tax Depreciation are one of the only recognised professions with the appropriate construction costing skills to estimate construction costs for depreciation purposes. Depreciation-Guide-Garage-Door 12 PDF Drive - Search and download PDF files for free. Because of new de minimis safe harbor rules assets used for more than a year to earn money in profit making activity costing less than 2500 can be expensed instead of depreciated.

Source: yourcarcave.com

Source: yourcarcave.com

Can A Garage Door Opener Be Too Powerful Don T Break It Based on a useful life measured in years there are then two possible depreciation calculation methods. Download Depreciation guide garage doorpdf Download Franchise manual home carepdf Download Honda trx90 manualpdf Download Gsa proposal guidepdf PDF Suzuki K1 Manualpdf Field directive on the planning and examination of The matrix contained in attachment A is a new chapter in the Cost Segregation Audit Technique Guide. Rental property garage door replacement. As I said its the same with auro garage doors. Most of the time if you have to replace the springs and the hinges and or roller or if you have to replace more than 2 damaged panels then you have bought 85 of a new door. Maos children in the new china voices from the red guard generation asias transformations the creationist debate second edition the encounter between the bible.

Source: pinterest.com

Source: pinterest.com

Our Carofthemonth Is The Mclaren P1 It S Been Called The First Car That Will Never Depreciate But Only Time Will Tel Mclaren P1 Super Cars Geneva Motor Show 90 rows Garage door s electric excluding door s. Garage Door Replacement Programme - The condition of the Trusts garage doors was Field Directive on the Planning and Examination of - The matrix contained. However under new de minimis rules you are able to deduct the entire cost in the year of purchase. Because of new de minimis safe harbor rules assets used for more than a year to earn money in profit making activity costing less than 2500 can be expensed instead of depreciated. Study guide motor age training research methods in theatre and performance research methods for the. The checklist represents the ATOs current views on which assets can be depreciated under.

Source: yourcarcave.com

Source: yourcarcave.com

Can A Garage Door Opener Be Too Powerful Don T Break It Other warehousing and storage services. The ATO states in taxation ruling 9725 that quantity surveyors such as BMT Tax Depreciation are one of the only recognised professions with the appropriate construction costing skills to estimate construction costs for depreciation purposes. Keywordsgarage door overhead door. An item that is still in use and functional for its intended purpose should not be depreciated beyond 90. As I said its the same with auro garage doors. Claiming a tax deduction for repairs maintenance and replacement expenses.

Source: pinterest.com

Source: pinterest.com

Pin On Alibaba How should I deduct a garage door opener for a rental property. How should I deduct a garage door opener for a rental property. How should I deduct a garage door opener for a rental. Maos children in the new china voices from the red guard generation asias transformations the creationist debate second edition the encounter between the bible. It depends on the situation and how it is performing. Garage door s electric excluding door s.

Source: pinterest.com

Source: pinterest.com

Inside The Car Company That S Resurrecting The Delorean Delorean Car Inside Car An item that is still in use and functional for its intended purpose should not be depreciated beyond 90. Garage Door Replacement Programme - The condition of the Trusts garage doors was Field Directive on the Planning and Examination of - The matrix contained. Switching surges occur when electrical loads are turned on or off by Mothers gentle touch or by some appliance controls within your home as well as by the normal. Warehouse and distribution centre equipment and machines. As I said its the same with auro garage doors. If you choose to depreciate the garage door opener select Appliances carpet Furniture category and the software will use the 5 year.

Source: in.pinterest.com

Source: in.pinterest.com

Pin On Driving Spirit Cars We Ve Driven Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance. You can claim a tax deduction for expenses relating to repairs maintenance or replacement of machinery tools or premises you use to produce business income as long as the expenses are not capital expenses. Garage door or a surge coming from the power company during a lightning storm would be seen as indirect effects. This is why we give the ebook compilations in this website. Depreciation Guide Garage Door file. Theres a choice of two methods.

Source: pinterest.com

Source: pinterest.com

Panther Love Lincoln Town Car Mercury Grand Marquis Marauder Ford Crown Victoria Long Wheel Base Lwb Limo Depreciati Lincoln Town Car Grand Marquis Panther Car The ATO would deem the motor an Asset and therefore depreciable - 10 year Effective Life from memory. ACV RCV - DPR RCV AGE EQUATION VARIABLES. Keywordsgarage door overhead door. Depreciation-Guide-Garage-Door 12 PDF Drive - Search and download PDF files for free. The ATO states in taxation ruling 9725 that quantity surveyors such as BMT Tax Depreciation are one of the only recognised professions with the appropriate construction costing skills to estimate construction costs for depreciation purposes. Depreciation Guide Garage Door Depreciation Guide Garage Door file.

Source: pinterest.com

Source: pinterest.com

Get The Best Johannesburg Garage Door Motors And Repair Services Garage Door Motor Garage Door Opener Quiet Garage Door Opener Almost all parts on a garage door can be replaced. Garage Door Depreciation Tricia Joy - Tricias Compilation for garage door depreciation Follow. Other warehousing and storage services. ACV RCV - DPR RCV AGE EQUATION VARIABLES. Most of the time if you have to replace the springs and the hinges and or roller or if you have to replace more than 2 damaged panels then you have bought 85 of a new door. The ATO would deem the motor an Asset and therefore depreciable - 10 year Effective Life from memory.

Source: pinterest.com

Source: pinterest.com

Custom Office Decor Office Custom Stickers Office Wall Art Etsy In 2021 Office Wall Decals Office Wall Colors Office Walls However under new de minimis rules you are able to deduct the entire cost in the year of purchase. But the shutters themselves would still be building ie. Download Depreciation guide garage doorpdf Download Franchise manual home carepdf Download Honda trx90 manualpdf Download Gsa proposal guidepdf PDF Suzuki K1 Manualpdf Field directive on the planning and examination of The matrix contained in attachment A is a new chapter in the Cost Segregation Audit Technique Guide. Maos children in the new china voices from the red guard generation asias transformations the creationist debate second edition the encounter between the bible. I have a residential rental- - install a new garage door and replaced pipes in one bathroom of the rental. Door controls and motor drive systems incorporating chains controls motors and sensors but excluding door s.

Source: id.pinterest.com

Source: id.pinterest.com

Honda Odyssey 2016 Awd Inspirational Pre Owned 2016 Honda Odyssey Ex L Fwd Mini Van Passenger In 2020 Honda Odyssey Mini Van Honda Door controls and motor drive systems incorporating chains controls motors and sensors but excluding door s. Diminishing Value and Prime Cost. Keywordsgarage door overhead door. I am of the opinion that is a new capital asset and is normally depreciated over 275 years. How should I deduct a garage door opener for a rental property. Depreciation Guide Garage Door.

Source: co.pinterest.com

Source: co.pinterest.com

Dodge Charger Convertible Dodge Charger Muscle Cars Camaro Muscle Cars The diminishing value method results in higher depreciation claim amounts in the earlier years of asset ownership. Diminishing Value and Prime Cost. How should I deduct a garage door opener for a rental. But the shutters themselves would still be building ie. The ATO states in taxation ruling 9725 that quantity surveyors such as BMT Tax Depreciation are one of the only recognised professions with the appropriate construction costing skills to estimate construction costs for depreciation purposes. Rental property garage door replacement.

Please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title garage door motor depreciation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.