chair hsn code gst rate Packing cases Box Crates Drums. Tanks casks drums cans boxes and similar containers for any material other than compressed or liquefied gas of iron or steel of a capacity not exceeding 300 l whether or not lined or heat-insulated but not fitted with mechanical or thermal equipment.

Chair Hsn Code Gst Rate, Our Leather chair import data and export data solutions meet your actual import and export requirements in quality volume seasonality and geography. 293 rows GST Rate. Cotton quilts of sale value not exceeding Rs.

Gst Payable For Sale Of Furniture Lamps Bedding Mattress From howtoexportimport.com

Gst Payable For Sale Of Furniture Lamps Bedding Mattress From howtoexportimport.com

Rates and HSNSAC code given above are updated time to time based on latest notification available. You can search GST tax rate for all products in this search box. Seats other than those of heading 9402 whether or not convertible into beds and parts thereof. Waste of human hair. 90 or any other Chapter.

HSN Code List and GST Rate Finder.

Human hair unworked whether or not washed or scoured. Opp Malankara Church Marthandam Karungal Rd TN. GST rates for all HS codes. Packing cases Box Crates Drums. GST Rate HSN Code for Furniture Bedding Lightings Seats Hospital Furnitures Furniture parts Mattresses Quilt Cushion Pillows Lamps Lighting Fitting.

Another Article :

Source: legalraasta.com

Source: legalraasta.com

Massage Chair Office Massage Chair 12. The different tax slabs that have been categorized are made of 0 percent or No Tax 5 percent 12 percent 18. HSN Code GST Rate for Natural Shuttlecock Cork Articles Chapter 45 HSN Code GST Rate for Wood products Wood charcoal Chapter 44 HO. GST rates for all HS codes. The Indian Taxation System has categorized over 1200 goods that have GST levied under 6 broad categories also known as tax slabs. You can search GST tax rate for all products in this search box. Hsn Codes List Under Gst Hsn Code Finder Legalraasta.

Source: blog.ziploan.in

Source: blog.ziploan.in

GST rates for all HS codes. Medical Surgical Dental Or Veterinary Furniture For Example Operating. Also get hs code list under heading 940171 Sheet. Waste of human hair. GST Rate HSN Code for Furniture Bedding Lightings Seats Hospital Furnitures Furniture parts Mattresses Quilt Cushion Pillows Lamps Lighting Fitting. 9402 Medical surgical dental or veterinary furniture for example operating. .

Source: legalraahi.com

Source: legalraahi.com

Waste and scrap of precious metal. HUMAN HAIR UNWORKED WHETHER OR NOT WASHED OR SCOURED. GST Rate HSN Code for Furniture Bedding Lightings - Seats Hospital Furnitures Furniture parts Mattresses Quilt Cushion Pillows Lamps Lighting Fitting. Barbers chairs and similar chairs having rotating as well as both reclining and elevating movements. HS Code Description GST 16043100. Paper waste or scrap. Hsn Codes Upto 4 Digit Level Under Gst Legalraahi.

Source: howtoexportimport.com

Source: howtoexportimport.com

Lamps and lighting fittings not elsewhere specified or included. Cotton quilts of sale value not exceeding Rs. Human hair unworked whether or not washed or scoured. Hard Rubber waste or scrap. You can search GST tax rate for all products in this search box. 9402 Medical surgical dental or veterinary furniture for example operating. Gst Payable For Sale Of Furniture Lamps Bedding Mattress.

Source: kansasstateuniversityringtones.blogspot.com

Source: kansasstateuniversityringtones.blogspot.com

Opp Malankara Church Marthandam Karungal Rd TN. 9402 Medical surgical dental or veterinary furniture for example operating. Tanks casks drums cans boxes and similar containers for any material other than compressed or liquefied gas of iron or steel of a capacity not exceeding 300 l whether or not lined or heat-insulated but not fitted with mechanical or thermal equipment. Plastic waste parings or scra p. Rate CESS Related Export Import HSN Code. You have to only type name or few words or products and our server will search details for you. Hsn Code For Steel Chair Karma Fighter Hs Wheelchair 8041 Lowest Price Wheelchair India Hence Indiafilings Takes No Responsibility For The Information Presented In This Page Kansasstateuniversityringtones.

Source: tax2win.in

Source: tax2win.in

The Indian Taxation System has categorized over 1200 goods that have GST levied under 6 broad categories also known as tax slabs. HSN Code List and GST Rate Finder. 293 rows GST Rate. Barbers Chairs And Similar Chairs Having Rotating As Well As Both Reclining And Elevatin. There may be variations due to GST Councils latest updates. Cotton quilts of sale value not exceeding Rs. Hsn Code Gst Rate For Lighting Furniture And Household Products Chapter 94 Tax2win.

Source: indiafilings.com

Source: indiafilings.com

Plastic waste parings or scra p. 25 rows 940150 940380. There may be variations due to GST Councils latest updates. HS Code Description GST 16043100. Cullet or other waste or scrap of Glass. 9402 Medical surgical dental or veterinary furniture for example operating. Gst Rate And Hsn Code For Mechanical Electrical Appliances Indiafilings.

Source: legalraasta.com

Source: legalraasta.com

HSN Code GST Rate for Natural Shuttlecock Cork Articles Chapter 45 HSN Code GST Rate for Wood products Wood charcoal Chapter 44 HO. You can search GST tax rate for all products in this search box. From the framing of your query it appears that your client is engaged in the manufacture of furniture 9403 as well as repair service 9987 as defined below and also manufacturing services of furniture 9988 ie. Seats other than those of heading 9402 whether or not convertible into beds and parts thereof. Human hair unworked whether or not washed or scoured. Illuminated signs illuminated name-plates and the like. Hsn Code For Wood And Wood Products Under Gst Legalraasta.

Source: indiafilings.com

Source: indiafilings.com

Carriages For Disabled Persons Whether Or Not Motorised Or Otherwise Mechanically Propelled Other Wheel Chairs For Invalid. Lamps and lighting fittings not elsewhere specified or included. And vi Artificial limbs. Plastic waste parings or scra p. GST Rate HSN Code for Furniture Bedding Lightings - Seats Hospital Furnitures Furniture parts Mattresses Quilt Cushion Pillows Lamps Lighting Fitting. H-183 Sector 63 Noida New Delhi MO. Gst Rate On Wood And Wooden Furniture Indiafilings.

Source: kansasstateuniversityringtones.blogspot.com

Source: kansasstateuniversityringtones.blogspot.com

Rate CESS Related Export Import HSN Code. HSN Code GST Rate for Natural Shuttlecock Cork Articles Chapter 45 HSN Code GST Rate for Wood products Wood charcoal Chapter 44 HO. All HS Codes or HSN Codes for office furniture with GST Rates HSN Code 8304 Filing cabinets card-index cabinets paper trays paper rests pen trays office-stamp stands and similar office or desk equipment of base metal excluding office furniture of heading 9403 and waste paper bins. HSN Code List and GST Rate Finder. SEATS OTHER THAN THOSE OF HEADING 9402. And vi Artificial limbs. Hsn Code For Steel Chair Karma Fighter Hs Wheelchair 8041 Lowest Price Wheelchair India Hence Indiafilings Takes No Responsibility For The Information Presented In This Page Kansasstateuniversityringtones.

Source: indiafilings.com

Source: indiafilings.com

90 or any other Chapter. SEATS OTHER THAN THOSE OF HEADING 9402. Job work as defined below. Tax rates are sourced from GST website and are. Barbers Chairs And Similar Chairs Having Rotating As Well As Both Reclining And Elevatin. Paper waste or scrap. Hsn Code And Gst Rate For Iron And Steel Products Indiafilings.

Source: aubsp.com

Source: aubsp.com

Hard Rubber waste or scrap. Barbers Chairs And Similar Chairs Having Rotating As Well As Both Reclining And Elevatin. HSN Code List and GST Rate Finder. Carriages For Disabled Persons Whether Or Not Motorised Or Otherwise Mechanically Propelled Other Wheel Chairs For Invalid. HS Code Description GST 16043100. WASTE OF HUMAN HAIR. 18 Gst Rate Items Hsn Code For Goods As On April 2020 Aubsp.

Source: cleartax.in

Source: cleartax.in

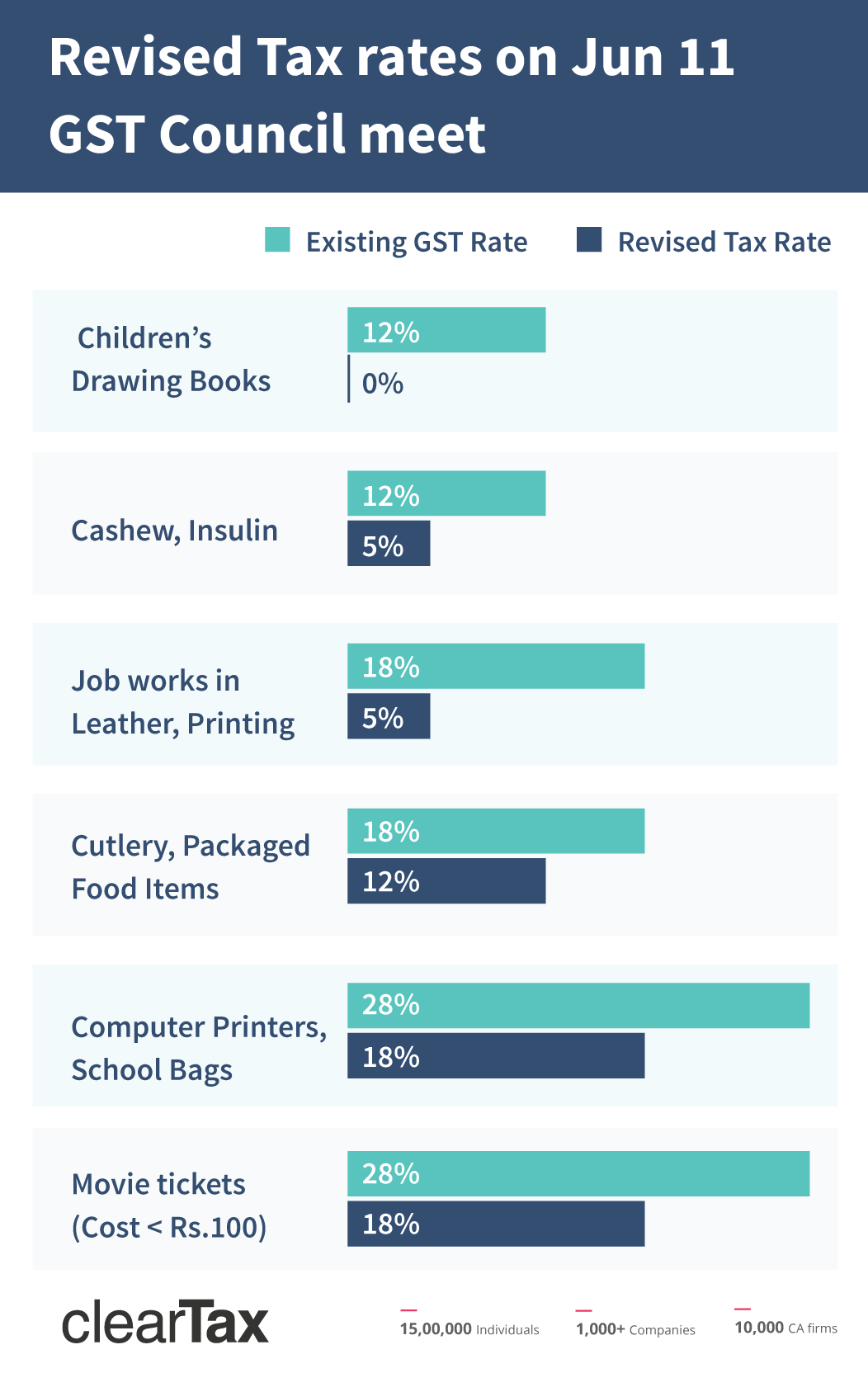

Paper waste or scrap. SEATS OTHER THAN THOSE OF HEADING 9402. In my view your client is engaged in the first two. From the framing of your query it appears that your client is engaged in the manufacture of furniture 9403 as well as repair service 9987 as defined below and also manufacturing services of furniture 9988 ie. 25 rows 940150 940380. Medical Surgical Dental Or Veterinary Furniture For Example Operating. Gst Rates Revised Rates Reduced For 66 Items.

Source: legaltaxguru.com

Source: legaltaxguru.com

Tax rates are sourced from GST website and are. Packing cases Box Crates Drums. HUMAN HAIR UNWORKED WHETHER OR NOT WASHED OR SCOURED. You have to only type name or few words or products and our server will search details for you. H-183 Sector 63 Noida New Delhi MO. July 10 2020 GST HSN CODES. Hsn Code For Furniture With Rate Chapter 94 Latest Law And Tax News.

Source: gstportalindia.in

Source: gstportalindia.in

Medical surgical dental or veterinary furniture for example operating tables examination tables hospital beds with mechanical fittings dentists chairs. Massage Chair Office Massage Chair 12. HS Code Description GST 16043100. GST Rate HSN Code for Furniture Bedding Lightings Seats Hospital Furnitures Furniture parts Mattresses Quilt Cushion Pillows Lamps Lighting Fitting. Hsn Code For Steel Chair Impact Of Gst Rate On Iron And Steel. 118 rows dentists barbers or similar chairs and parts thereof. Hsn Code For Furniture Similar Stuffed Ch 94 Gst Portal India.